If you drive in Denver, Colorado, then you could benefit from Safeco RightTrack® by saving hundred of dollars with this cool driving device.

Safeco RightTrack is an app provided by the Liberty Mutual Group/SafeCo Insurance, one of the nations top auto insurance companies that offers insurance to motorists in Colorado. The purpose of the device is to more accurately track your driving habits to help you save you money on your insurance premiums. This is a much fairer strategy than basing your rate on your demographic, type of car and region you live in.

How Safeco RightTrack® Works

Insurance companies know that safe drivers are less likely to make a claim, but it’s hard to work out who is a safe driver, and who isn’t, just from demographic information (such as your age and where you live). It’s much more accurate to collect information about a driver’s habits and then use that to work out how much they should pay in premiums. Safe, cautious drivers who stay under the speed limit will, naturally, pay less than those who brake suddenly, take corners at high speed and disobey road safety laws.

There are two ways in which you can use Safeco RightTrack; either through their plug-in device or their mobile app.

- The plug-in device is a small device containing a suite of sense that Denver motorists install on their vehicles to track their driving. The device connects to an OBD-II port which is usually located under the dashboard.

- The other option is to install the Safeco Right Track mobile app. The app works by using your phone’s onboard sensors to track your driving performance. The benefit of the app is that it is straightforward to download and install on either Android or iPhone devices.

How Much Can You Save In Denver With A RightTrack® Device?

The savings from installing a Safeco RightTrack ® device are substantial. SafeCo Insurance Reviews says that it will apply a discount of between 5 and 30 percent, depending on its interpretation of the data. The cuts are automatically applied to your policy, based on your driving behavior – there’s no need to call the company or negotiate rates.

How Can You Get A Safeco RightTrack® Device?

If you’ve decided to have a Safeco Right Track device fitted, how can you make it work for you and get close to the maximum 30 percent off your monthly premiums?

- Drive Less Often – Insurance companies know that the further you drive, the more likely you are to have an accident at some point. The less you drive, therefore, the higher your discount should be, all else equal.

- Avoid Hard Braking – Insurance companies consider hard braking dangerous. You might just like braking hard, but from the perspective of the insurer, it’s more likely because you’re not paying attention to the road ahead. Hard braking increases your chances of being shunted from behind and also ramming into vehicles queued up ahead. If you want your premiums to fall, then it’s best avoided.

- Drive Less At Night – Driving at night in Denver, Colorado, between midnight and 4 am is more dangerous than during the daytime. Limit your driving to the day if you want to cut costs.

- Don’t Accelerate Rapidly – Rapid acceleration is a proxy for aggressive driving and could be an indication of your overall road temperament, including your propensity to perform dangerous overtaking maneuvers.

What About Your Personal Data?

Although the Safeco system collects a lot of data about your driving habits, it won’t affect your ability to get insurance in the future. Personally identifiable information – such as the data transmitted from your plug-in device to Liberty Mutual Group/Safeco Insurance – is not distributed to other parties outside of the company.

Safeco RightTrack®, therefore, offers Colorado drivers a low-risk way to reduce their premiums, especially if you follow safe driving habits.

Do you feel like you are a good driver and deserve a discount? Well, now is your chance to save money on your car insurance with Safeco RightTrack®

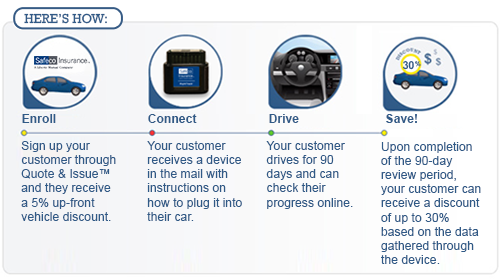

Safeco Insurance has introduced a program to reward good drivers in Colorado. SafeCo RightTrack® is a telematics device that is easy to use and guarantees 5% savings just for signing up. The small device easily plugs into your car and monitors your driving habits. Driving habits include: stopping and starting patterns, the time of day that you drive and your mileage.

You use the device for 90 days and receive updates online about your progress. The best drivers receive up to a 30% discount on their car insurance.

Setting Up Your RightTrack® Device

Setting up a Safeco RightTrack® device is relatively straightforward.

First, you’ll need to contact Liberty Mutual Group, tell them that you’d like to use Safeco RightTrack® as part of your insurance policy.

Next, Liberty Mutual Group will come and install the plug-in device on your vehicle into the aforementioned OBD-II socket on your car.

Then you’ll need to drive with the unit for around 90 days for it to collect sufficient data about your driving habits, including how much you drive and how suddenly you accelerate or decelerate. Liberty Mutual Group then crunches the numbers to see whether you’re a safe driver or not.

Finally, based on the results, you’ll be granted a discount on your insurance premium. Liberty Mutual Group says that Denver residents are guaranteed savings and that their premiums won’t go up after having the device fitted.

Safeco wants to reward you and not punish you so your rate will not be negatively impacted. With RightTrack, you can’t lose and many of our Denver clients are taking advantage of this new technology to get the best insurance rates.

We offer the RightTrack® option to all of our SafeCo customers.

To get Safeco RightTrack® you must have a Safeco policy. We can get you a Safeco insurance quote and compare it against 32 other insurance companies.

Just fill out this form to get a free online quote and see how much you can save or contact us today!