Insurance companies traditionally have exclusions on personal auto insurance that do not cover the driver if an accident happens while the vehicle is being used to transport people for a fare. Since the introduction of Transportation Network Companies (TNC) like Uber and Lyft, this has become widely talked about. As an insurance agent, we often get questions like:

- “When does commercial use start and end?”

- “What is actually covered?”

- “Do I need special insurance for Lyft or Uber?”

- “Will the insurance coverage be expensive?”

- “Doesn’t my rideshare company provide insurance coverage?”

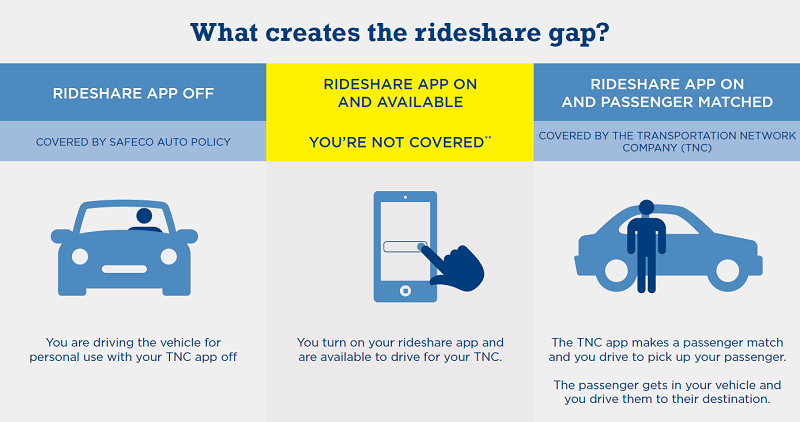

These are all very good questions and to answer them, we have to use technical terms. In simple terms, add an endorsement to your personal auto insurance. The cost is usually around $10 per month and offered by top-rated insurance companies like Travelers and Safeco. This infographic provides a great visual of the different stages of a service like Uber and any potential gaps. Contact Denver Insurance LLC for more information or a free auto insurance quote.

Per Uber’s policy on 7/8/2016, Uber will provide comprehensive and collision coverage during a trip and the coverage is contingent, meaning you have to have comprehensive and collision coverage on your personal policy. Comprehensive and collision coverage is to replace or repair your vehicle. If your rideshare app is on but you don’t have a passenger, Uber could deny your claim because the accident didn’t happen during the ride. Your personal insurance company could deny your claim because you were driving commercially. This gap in coverage is highlighted in yellow above. Also, if you do not have comprehensive and collision coverage on your personal insurance policy then Uber could deny your claim, even if the accident happens during the ride.

Per Lyft’s latest insurance policy information online, Lyft will provide comprehensive and collision coverage, on a contingency basis, meaning that you have to have comprehensive and collision coverage on your personal policy. Lyft’s comprehensive and collision deductible is currently $2,500, according to their site. Comprehensive and collision coverage is to replace or repair your vehicle. Lyft now provides contingent liability coverage while you’re driver mode is on but no ride is accepted. Lyft still does not provide comprehensive or collision coverage while you’re in driver mode. If you want coverage to repair/replace your car while in driver mode then you will want to add a rideshare endorsement to our personal auto insurance policy. Again, the additional cost is approximately $10 per month.

Lyft and Uber services are great and definitely a needed mode of transportation! But the service might create a higher risk because they carry more passengers, drive in unfamiliar areas, make frequent stops on the road and violate more traffic laws to get to a fare.

Always check Uber, Lyft or any Transportation Network Company frequently to stay up-to-date with any changes in their insurance policy.